-

Seasonal loans and marketing training

lead to aquaculture success for

small-scale farmers in Sierra Leone

In a first-time trial, small-scale fish farmers in Tonkolili District have accessed loans to buy inputs for their fish farms, enabling them to grow their businesses, increase profits and boost household consumption of fish.

In Sierra Leone, Tonkolili District is one of the poorest and most nutritionally insecure regions, with a 25 percent childhood stunting rate. Involving poor farmers in small-scale aquaculture, particularly with a business focus, has huge potential to help combat this problem by increasing fish consumption and incomes.

Yet despite the large number of perennial swamps suited to fish farming, the small-scale aquaculture sector is largely undeveloped, and poor farmers face several barriers when trying to establish a fish farm business.

Since 2017, WorldFish through the CGIAR Research Program on Fish Agri-Food Systems (FISH) has led the Feed the Future Scaling Up Aquaculture Production project. With funding from USAID, the project is testing pro-poor business models in Tonkolili District to enable farmers to engage in small-scale fish farming—with promising results.

Loans available to fish farmers for the first time

For rural fish farmers in Sierra Leone, particularly those new to aquaculture, accessing capital is difficult. Typically, farmers are resource poor and lack the collateral to guarantee a bank’s loan repayment. And microcredit institutions require repayments almost immediately, which is not possible for tilapia farmers who can only start repayments at the end of the four- to five-month season after selling their harvests.

To solve this problem, in 2017 the project partnered with a microfinance organization—Apex Bank—to provide seasonal loans to fish farmers.

Fish harvesting in Manasi Village, Tonkolili District, Sierra Leone. Photo by Yeanoh Dumbuya

The loans are available through financial service associations (FSAs), which are community-owned financial institutions that extend loans to members to advance their farming activities and agricultural businesses. The FSAs are operated by Apex Bank, supervised by the Central Bank of Sierra Leone, and supported by the International Fund for Agricultural Development (IFAD) and the Government of Sierra Leone.

In August 2017, seasonal loans were disbursed to 65 eligible fish farmers (42 men and 23 women including 22 youths). Eligible farmers are those who own or have access to suitable land with access to water for farming, had already constructed their fish ponds and were working with the SAP project.

At the start of the first fish farming cycle in September 2017, each farmer accessed an average loan of 500,000 Sierra Leonean Leone (USD 68). Each month they paid 2.5 percent in interest and had to repay the principal loan amount after harvesting, which occurred between March and May 2018.

The loans enabled the fish farmers to buy inputs such as hydrated lime, fertilizer and feed¾which are needed to increase fish growth, health and nutrition¾from suppliers such as the West African Rice Company and a community agro-trader. These suppliers were established by the SAP project in 2017 to help develop the fish value chain.

In addition to the loans, the project supported Apex Bank staff to provide the 65 loan recipients with training on practical ways to manage their finances and save income. The four-day training programs¾delivered in the farmers’ local languages¾were conducted in Bumbuna, Manasi and Matele Bana villages in Tonkolili District.

Establishing the seasonal loan model—a first for Sierra Leone—was a major achievement for the project explains Dr. Sunil Siriwardena, SAP Project Manager.

“It takes trust to give loans to people, and it is therefore important that we keep that trust that has existed between WorldFish, Apex Bank and the farmers.”

Farmers who pay back their loans without defaulting with the bank can then borrow money again for additional farming and economic activities, which encourages farmers to continue developing their businesses.

Finding markets for the first major tilapia harvest

Besides limited access to credit, most farmers who take up small-scale aquaculture have little knowledge about the best ways to market and sell their harvest.

From January to March 2018, just before harvest time, the 65 farmers worked with the SAP project to research different avenues to sell their fish, such as in guesthouses and local and district markets.

“We checked and analyzed prizes at different markets and did research to understand what buyers are demanding, which helped us to improve on our management practices for better fish growth” – Hawanatu Sankoh, woman farmer, Magbaft community

After carrying out the research, farmers helped develop advertisements and jingles for airing on local radio stations to promote their products.

Thanks to these efforts, the farmers were successful in finding markets for their tilapia harvests. The farmers capitalized on a niche for fresh tilapia in the local markets, which are traditionally dominated by smoked and dried marine fish. This was the first time that fresh tilapia was sold in these volumes in the local markets, providing a welcome income for the former subsistence farmers.

The success of the marketing efforts was also evidenced by 60 of the 65 farmers fully repaying their loans (a 92.3 percent repayment rate) and the remaining five making partial payments.

The farmers also produced enough fish to keep part of their tilapia harvests for home consumption, with amounts ranging from 8 to 26.3 kg per household.

For 37-year-old woman fish farmer Kumba Bangura, participating in the SAP project has been life changing.

“We have found a new way of life doing fish farming. At first, we thought it was difficult and risky since the practice is new, but now we know it is worth the risk and I’m happy to be part of the project,” says Kumba, who lives in Bumbuna community in the Kalansongoia chiefdom.

Scaling up to reach more poor farmers

The success of the seasonal loan program and marketing activities demonstrated the potential for small-scale aquaculture to improve the lives of poor households.

Following on from the trial seasonal loan program, a larger pilot will be established before the end of 2018 that will target more farmers in Tonkolili District.

The seasonal loan model also has potential to be scaled up to other districts or countries. To this end, the SAP project organized a knowledge-sharing and learning platform in August 2018 with all stakeholders, including NGOs, who could scale up this activity.

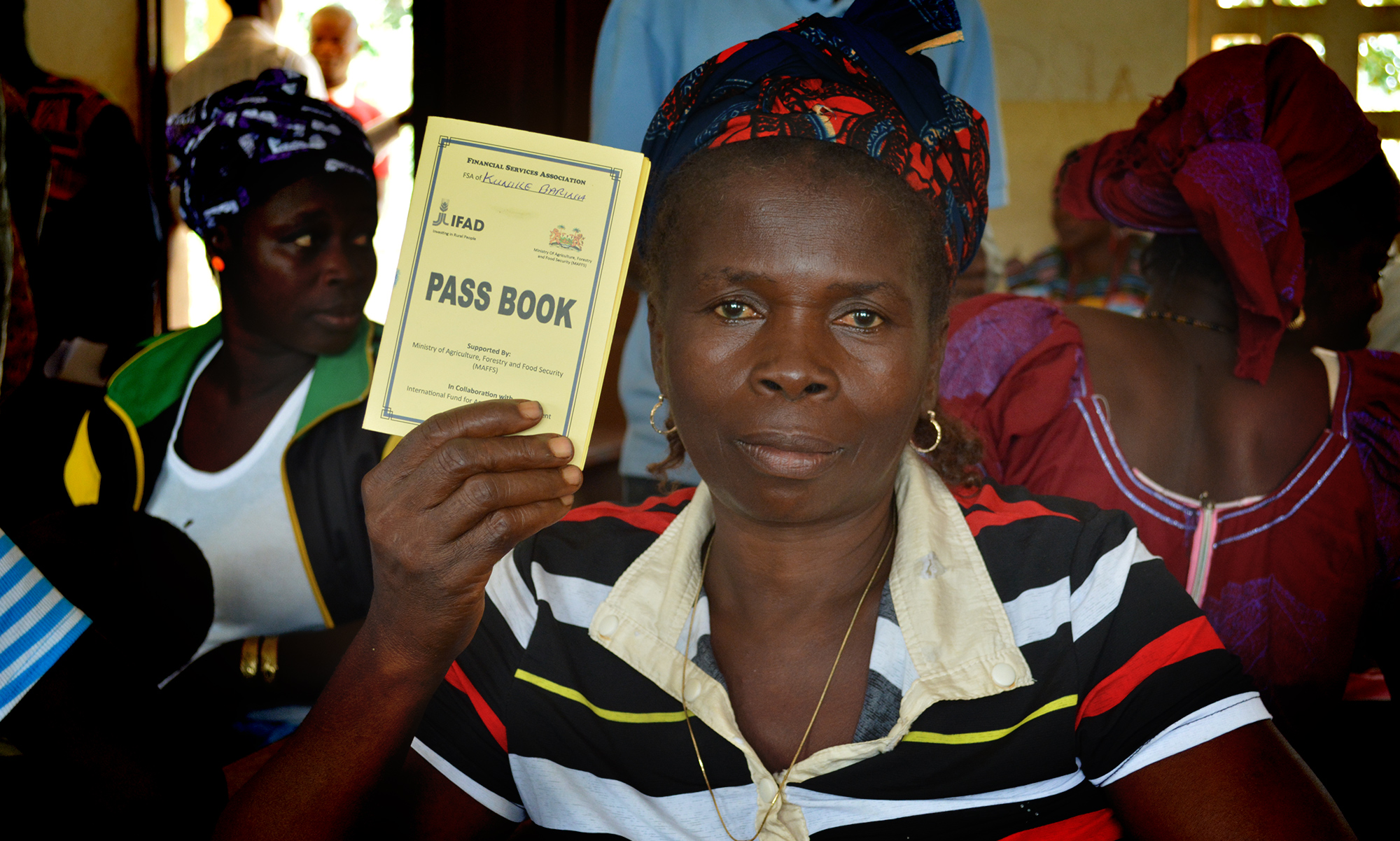

A farmer in Bumbuna community repaying her loan

Because of the loan repayment success rate, an additional 124 loans were disbursed to farmers in 2018. Of these, the FSAs disbursed loans to 69 farmers and a second microfinance institution, Salone Microfinance Trust, disbursed loans to 55 farmers.

As for finding new opportunities, SAP will work with farmers to target secondary markets, such as restaurants and hotels, and market their produce in neighboring districts.

By enabling poor households to establish sustainable and self-reliant aquaculture businesses, households can boost their fish production, consumption and production—all of which can benefit poor families, the Tonkolili District and the country.

Project

Feed the Future Sierra Leone Scaling Up Aquaculture Production (SAP)Donor:

United States Agency for International Development (USAID)Partners:

Sierra Leone Ministry of Fisheries and Marine ResourcesSierra Leone Ministry of Agriculture, Forestry and Food Security

Catholic Relief Services

Helen Keller International

West African Rice Company

Africa Lead

Njala University

University of Illinois

Related sustainable development goals

Tags

Africa, aquaculture, development, entrepreneurship, food security, Sierra Leone, tilapiaImpacts

eligible fish farmers (42 men and 23 women including 22 youths) received loans averaging USD 68

of tilapia sold per farmer during the harvest season, at competitive prices ranging from USD 0.50 to USD 1.60 per kilogram depending on the size

of tilapia retained per household for home consumption

Photo credits - WorldFish. Published on 28 September 2018.